UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material | |

United Parcel Service, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

| PAYMENT OF FILING FEE (CHECK | |||

| ☑ | No fee | ||

| ☐ | Fee paid previously with preliminary | ||

| ☐ | |||

Notice of 2022 Annual Meeting

of Shareowners and Proxy Statement

Thursday, May 5, 2022

8:00 a.m. Eastern Time

www.virtualshareholdermeeting.com/UPS2022

|

|  | 3 |

United Parcel Service, Inc.55 Glenlake Parkway, N.E.Atlanta, GA 30328

March 15, 2019

United Parcel Service, Inc. March 21, 2022 Dear Fellow Shareowners: |

|  | ||

| |||

It is my pleasure to invite you to join us at UPS’s 2019the 2022 Annual Meeting of Shareowners. Since our last Annual Meeting, UPS has continued our sweeping transformation that is touching every part of our business — from leadership and culture to our operations, processes and the way we go to market.

In short, UPS is Strong Today, and CREATING our Tomorrow. We embarked on this transformation from a position of strength, with a commitment to create our own future. UPS has a powerful brand, an exceptional and essential global network, and a broad product and solutions portfolio that is designed to meet the current and emerging needs of our customers. UPS produces strong cash flow, the industry’s highest margins, and a solid balance sheet.

Our transformation is designed to achieve three principal goals: generate high-quality revenue growth; drive efficiencies and cost reductions that will improve our margins; and further develop our talent as we continue to foster a culture of innovation.

The investments we are making in our network, people, technology and products will improve leverage in our global operations – and are creating greater differentiation for UPS in the markets we serve. Our customers will benefit from more flexibility, consistency and visibility in how packages are moved through our network. By enhancing the value we create for our customers, we will generate higher revenue per package, better balance between our business and residential-based volumes and a higher level of earnings growth.

We made substantial progress on the network investment initiatives we first discussed in early 2017. We are implementing technology that is making our network and our company more efficient, more flexible, more resilient, and more anticipatory. The result is a network that enables us to attract additional opportunities for high quality growth and generate improved operating margins.

We are capturing opportunities through digital technology and automation that are changing the way people and companies connect and communicate. Additionally, our advanced methods of optimizing the flows of freight and packages with available capacity results in improved transit times for our customers and better asset utilization and network efficiency. To build on those improvements and fulfill the growing demand for our services, we are significantly expanding capacity through comprehensive investments across our operations.

These improvements have succeeded in large part due to the innovative ideas and commitment to service our people bring to UPS everyday. We will continue to shape our culture so we can seize on the new market opportunities of the 21st century.

I want to encourage all of our shareowners to vote. This is your opportunity to share your views with the Company.Company and the Board of Directors. We look for meaningful ways to engage with our investorstake this feedback into account as we continually seekperform our board responsibilities.

The uncertainty resulting from the pandemic continued to challenge us during 2021. Despite this, the Company capitalized on opportunities to create long-term value as it continued to execute its strategy – Customer First, People Led, Innovation Driven.

Carol completed a successful first full year as CEO, aligning UPS leadership and executing under her Better, Not Bigger strategic framework. Carol’s leadership and the board’s oversight have strengthened the link between the Company’s strategic framework and its financial commitments, connecting purpose to strategy.

We understand that delivering on our financial targets is critical to creating long-term shareholder value. In 2021, the Company generated record results, including strong profit growth through increased margins in all segments, primarily facilitated by management’s focus on executing strategic initiatives, including targeted international growth, healthcare, and small and medium-sized businesses. All of this occurred with an increased emphasis on attracting, developing, and retaining a motivated and valued workforce that embraces diversity and inclusion. The Company’s emphasis on taking care of its customers and employees positions us well for sustainable success.

In 2021, the board oversaw the development of new sustainability and ESG goals, including the goal of becoming carbon neutral by 2050, the goal of having 28% women in management and the goal of maintaining 35% ethnically diverse company management. The board also facilitated the first publication of the Company’s EEO-1 report and the formal delegation of human capital oversight responsibility to the board’s Compensation Committee. Our five new directors have contributed significantly to boardroom discussions related to the advancement of these matters. However, we understand there is still more work to do at this important time.

The board is also proud of the efforts of all UPSers who helped drive our purpose - moving our world forward by delivering what matters. Since its founding almost 115 years ago, UPS has fostered an employee ownership culture, with employees regularly answering the call to help one another and our communities. In 2021, the Company achieved a number of significant milestones, including delivering over 1 billion doses of the COVID-19 vaccine. The board continues to believe that this culture is significantly facilitated by the Company’s capital structure. UPS’s unique employee ownership model has helped it grow our business, improveand thrive by allowing management to run the Company with a sense of purpose by focusing on sustainable long-term value creation benefiting all stakeholders. It is indicative of this culture that the board and management have embraced the increased stakeholder focus on environmental, social and governance and increase shareowner value.matters.

I want to encourage all my fellow shareowners to vote. We are grateful to those shareowners who have previously shared their views. As we approach the Annual Meeting, I encourage you to contact us with any questions or feedback at 404-828-6059.

On behalf of the entire Board of Directors, thank you for your continued support of UPS.support.

David P. Abney

William JohnsonChairman and Chief Executive OfficerUPS Board Chair

| 4 |   | Notice of Annual Meeting of Shareowners and |

| Notice of UNITED PARCEL SERVICE, INC. 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328 |

| ● | Date and Time:May | |

| ● | Place:The meeting will be held exclusively online via webcast at: www.virtualshareholdermeeting.com/UPS2022. | |

| ● | Record Date:March | |

| ● | Distribution Date:A Notice of Internet Availability of Proxy Materials or the | |

| ● | Voting:Holders of class A common stock are entitled to 10 votes per share; holders of class B common stock are entitled to one vote per share.Your vote is important. Please vote as soon as possible | |

| ● |

|

Important Notice Regarding the Availability of Proxy Materials for the Shareowner Meeting to be heldHeld on May 9, 2019:5, 2022: The Proxy Statement and our 20182021 Annual Report are available at www.proxyvote.com.Questions? Call 404-828-6059 (option 2).

By order of |

| Voting Choices | Board Voting Recommendations | Page | ||||

Company Proposals: | ||||||

| 1. | Elect 12 director nominees named in the Proxy Statement to serve until the 2020 Annual Meeting and until their respective successors are elected and qualified | ●Vote for all nominees ●Vote against all nominees ●Vote for some nominees and against others ●Abstain from voting on one or more nominees | FOR ALL | 20 | ||

| 2. | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019 | ●Vote for ratification ●Vote against ratification ●Abstain from voting on the proposal | FOR | 57 | ||

Shareowner Proposals (if properly presented): | ||||||

| 3. | Prepare an annual report on lobbying activities | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 60 | ||

| 4. | Reduce the voting power of class A stock from 10 votes per share to one vote per share | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 62 | ||

| 5. | Prepare a report to assess the integration of sustainability metrics into executive compensation | ●Vote for the proposal ●Vote against the proposal ●Abstain from voting on the proposal | AGAINST | 64 | ||

Norman M. Brothers, Jr.

|

|

TableItems of ContentsBusiness

| Voting Choices | Board Voting Recommendations | Page | |||

| Company Proposals: | ||||||

| 1. Elect 13 director nominees named in the Proxy Statement to serve until the 2023 Annual Meeting and until their respective successors are elected and qualified | ●Vote for all nominees ●Vote against all nominees ●Vote for some nominees and against others ●Abstain from voting on one or more nominees | FOR EACH NOMINEE | 22 | |||

| 2. Approve, on an advisory basis, named executive compensation | ●Vote for the resolution ●Vote against the resolution ●Abstain from voting on the resolution | FOR | 56 | |||

| 3. Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022 | ●Vote for ratification ●Vote against ratification ●Abstain from voting on ratification | FOR | 59 | |||

| Shareowner Proposals: | ||||||

| 4. - 9. Advisory votes on 6 shareowner proposals, only if properly presented | ●Vote for each proposal ●Vote against each proposal ●Abstain from voting on the proposals | AGAINST EACH PROPOSAL | 62 |

| 5 |

| Proxy Statement UNITED PARCEL SERVICE, INC. 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328 |

This Proxy Statement contains important information on Company matters that require your vote atabout the 20192022 Annual Meeting of Shareowners (the “Annual Meeting”). We are providing these proxy materials to you because you own shares of United Parcel Service, Inc. common stock and our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. We are first mailing this Proxy Statement to our shareowners on or about March 15, 2019. The Annual Meeting will be held online only on May 9, 2019,5, 2022, at 8:00 a.m. Eastern Time, at Hotel du Pont, 11thwww.virtualshareholdermeeting.com/ UPS2022. Shareowners can participate, ask questions, vote and Market Streets, Wilmington, Delaware.examine our shareowner list during the meeting through this website.

All properly executed written proxies, and all properly completed proxies submitted bythrough the Internet or by telephone, that are delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting. Only owners of record of shares of the Company’s common stock as of the close of business on March 11, 2019, the9, 2022 (the “Record Date”,) are entitled to notice of, and to vote at, the Annual Meeting (or any adjournment or postponement of the meeting)Annual Meeting). We are first mailing this Proxy Statement on or about March 21, 2022.

This summary highlights information contained elsewhere in this Proxy Statement.

Corporate Governance

Following is a brief overview ofare some of our corporatekey governance policies and practices:

| ● | We maintain | |

| ● | We have | |

| ● | ||

| ● | We hold annual elections for all directors; and we provide for majority voting in uncontested director elections; | |

| ● | ||

| ● | The | |

| ● | ||

| ● | We regularly engage with | |

| ● | ||

| ● |

| 6 |   | Notice of Annual Meeting of Shareowners and |

Proxy Statement Summary

Our Board

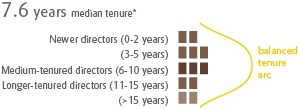

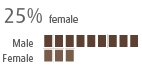

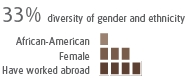

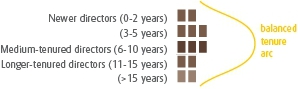

Our independent Board of Directors is responsible for the strategic oversight of our Company. Beyond aUPS. A summary of their relevant skills, experience and diversity is below. For more information, see page 22.

Our directors’ broad range ofprofessional skills and experiences, we seek contribute to maintain anoptimal mixa wide range of newer directors, who bring fresh perspectives andlonger-tenured directors, who have contributed to developing our strategy over time, and have acquired an in-depth understanding of our global organization. A majority of non-management independent directors ensuresrobust debate and challenged opinionsin the boardroom while

diversityDiversity in our boardroom supports UPS’s continued success

| 7 |

Table of gender, age and ethnicity contributes toContents

Election of Directors

As a diverse range of views.

The board believes that the 2019group, our 13 director nominees are of an appropriate compositionappropriately skilled and experienced to effectively oversee and constructively challenge the performance of management in the execution of our strategy.

As a group, our 12 director nominees have the skills and experience to effectively oversee a global organization

|

|

The board has been meaningfully refreshed since 2010 with 7 independent directors joining, and 5 departing the board*recommends you vote FOR

|

|

Our Chairman and CEO provides strong leadership and is supported – and constructively challenged – by an independent board

|

|

We believe that diversity in our boardroom supports UPS’s continued success and advantage

|  |  |

|

|

The table below provides summary information about the 12 director nominees.nominee listed below. For more information, see page 20.22.

| Name | Age | Director Since | Occupation | Committee(s) | Other Public Company Boards |

| Independent Directors | |||||

| Rodney C. Adkins | 60 | 2013 | Former Senior Vice President, International Business Machines | –Risk (Chair) –Compensation | 4(2) |

| Michael J. Burns | 67 | 2005 | Former Chairman, Chief Executive Officer and President, Dana Corporation | –Audit | 0 |

| William R. Johnson(1) | 70 | 2009 | Former Chairman, President and Chief Executive Officer, H.J. Heinz Company | –Nominating and Corporate Governance (Chair) –Executive

| 1 |

| Ann M. Livermore | 60 | 1997 | Former Executive Vice President, Hewlett-Packard Company | –Compensation (Chair) –Risk –Executive | 2 |

| Rudy H.P. Markham | 73 | 2007 | Former Financial Director, Unilever | –Compensation –Nominating and Corporate Governance | 2 |

| Franck J. Moison | 65 | 2017 | Former Vice Chairman, Colgate-Palmolive Company | –Nominating and Corporate Governance –Risk | 1 |

| Clark T. Randt, Jr. | 73 | 2010 | Former U.S. Ambassador to the People’s Republic of China | –Compensation –Nominating and Corporate Governance | 3 |

| Christiana Smith Shi | 59 | 2018 | Former President, Direct-to-Consumer, Nike, Inc. | –Compensation –Risk | 2 |

| John T. Stankey | 56 | 2014 | Chief Executive Officer, WarnerMedia | –Audit | 0 |

| Carol B. Tomé | 62 | 2003 | Chief Financial Officer and Executive Vice President — Corporate Services, The Home Depot, Inc. | –Audit (Chair) | 0 |

| Kevin Warsh | 48 | 2012 | Former Member of the Board of Governors of the Federal Reserve System, Distinguished Visiting Fellow, Hoover Institution, Stanford University | –Compensation –Nominating and Corporate Governance | 0 |

| Non-Independent Director | |||||

| David P. Abney | 63 | 2014 | Chairman and Chief Executive Officer, United Parcel Service, Inc. | –Executive (Chair) | 1 |

| Name | Age | Director Since | Occupation | Committee(s) | Other Public Company Boards | |||||

| Independent Directors | ||||||||||

| Rodney Adkins | 63 | 2013 | Former Senior Vice President, International Business Machines Corporation | – Risk (Chair) – Compensation and Human Capital | 3 | |||||

| Eva Boratto | 55 | 2020 | Chief Financial Officer, Opentrons Labworks, Inc. | – Audit (Chair) | 0 | |||||

| Michael Burns | 70 | 2005 | Former Chairman, President and Chief Executive Officer, Dana Incorporated | – Audit | 0 | |||||

| Wayne Hewett | 57 | 2020 | Senior Advisor to Permira, and Chairman of Cambrex Corporation | – Audit | 2 | |||||

| Angela Hwang | 56 | 2020 | Group President, Pfizer Biopharmaceuticals Group, Pfizer, Inc. | – Audit | 0 | |||||

| Kate Johnson | 54 | 2020 | Former President, Microsoft U.S., Microsoft Corporation | – Nominating and Corporate Governance – Risk | 0 | |||||

| William Johnson(1) | 73 | 2009 | Former Chairman, President and Chief Executive Officer, H.J. Heinz Company | – Nominating and Corporate Governance (Chair) – Executive | 1 | |||||

| Ann Livermore | 63 | 1997 | Former Executive Vice President, HP Inc. | – Compensation and Human Capital (Chair) – Risk – Executive | 3 | |||||

| Franck Moison | 68 | 2017 | Former Vice Chairman, Colgate-Palmolive Company | – Nominating and Corporate Governance – Risk | 1 | |||||

| Christiana Smith Shi | 62 | 2018 | Former President, Direct-to-Consumer, Nike, Inc. | – Compensation and Human Capital – Risk | 1 | |||||

| Russell Stokes | 50 | 2020 | President and Chief Executive Officer, GE Aviation Services | – Compensation and Human Capital – Nominating and Corporate Governance | 0 | |||||

| Kevin Warsh | 51 | 2012 | Former Member of the Board of Governors of the Federal Reserve System, Distinguished Visiting Fellow, Hoover Institution, Stanford University | – Compensation and Human Capital – Nominating and Corporate Governance | 1 | |||||

| Non-Independent Director | ||||||||||

| Carol Tomé | 65 | 2003 | Chief Executive Officer | – Executive (Chair) | 1 | |||||

| 8 |   | Notice of Annual Meeting of Shareowners and |

Proxy Statement Summary

Executive Compensation

Compensation Practices

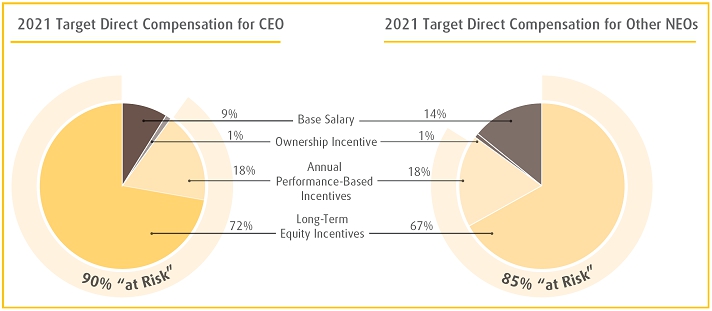

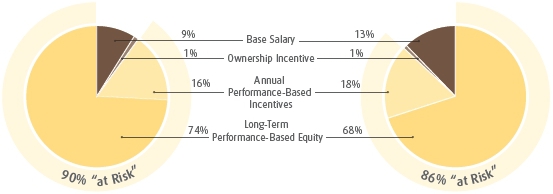

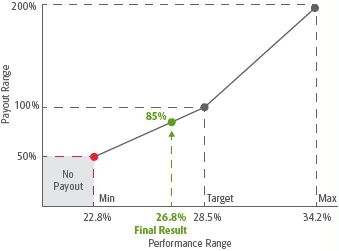

A significant portion of executive compensation is at-risk and tied to Company performance over a multi-year period.performance. This aligns executive decision-making with the long-term interests of our shareowners. We also have a long-standinglongstanding owner-manager culture. TheOur compensation and governance practices that support these principles include:

| ● | ||

| ● | Annual and long-term performance incentive awards | |

| ● | Annual and long-term performance incentive award payouts that are dependent upon the achievement of multiple distinct goals, avoiding overemphasis on any one metric and mitigating excessive risk-taking; | |

| ● | Long-term performance incentive awards | |

| ● | Stock option awards that vest | |

| ● | Incentive | |

| ● | Incentive | |

| ● | No tax gross-ups |

20182021 Compensation Actions

Key 20182021 compensation decisions foraffecting our Named Executive Officers (“NEOs”)executive officers included:

| ● | Most total direct compensation | |

| ● | Base salary increases for the NEOs as | |

| ● | Bifurcating the performance period for the annual incentive awards to account for the uncertainty attributable to the COVID-19 pandemic. See page 35; | |

| ● | Annual incentive awards for | |

| ● | Previously granted |

Annual Say on Pay Vote

We maintain executive compensation programs that support the long-term interests of our shareowners. We provide shareowners the opportunity to vote annually, on an advisory basis, to approve the compensation of our NEOs, as described in the Compensation Discussion and Analysis section and in the compensation tables and accompanying narrative disclosure in this proxy statement. For more information, see page 56.

The board recommends you vote FOR the advisory vote to approve named executive officer compensation.

Ratification of the Appointment of the Independent Registered Public Accounting Firm

The Board of Directors has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2019.2022. The board recommends that you ratify vote FOR the appointment. Following is summary information aboutratification of the fees billed to us byappointment of Deloitte & Touche LLP during the years ended December 31, 2018 and 2017.LLP. For more information, see page 57.59.

| 2018 | 2017 | |||||

| Fees Billed: | ||||||

| Audit Fees | $ | 14,558,000 | $ | 14,608,000 | ||

| Audit-Related Fees | $ | 968,000 | $ | 1,234,000 | ||

| Tax Fees | $ | 825,000 | $ | 720,000 | ||

| Total | $ | 16,351,000 | $ | 16,562,000 | ||

Shareowner Proposals

The board recommends you vote AGAINST the shareowner proposals (1) requesting the preparation of an annual report on lobbying activities, (2) seeking to reduce the voting power of our class A stock and (3) requesting the preparation of a report assessing the feasibility of incorporating sustainability metrics into executive compensation.proposals. More information about these proposals is available startingstarts on page 60.62.

| |

| 9 |

Our Board of Directors employsWe maintain robust governance policies and practices that foster effective oversightbenefit the long-term interests of critical matters such as strategy, management succession planning, financialall stakeholders. We regularly review and update our corporate governance practices in response to the evolving needs of our business, shareowner and other controls, risk management and compliance. The board reviews our major governance documents, policies and processes regularly in

the context of current corporate governance trends,stakeholder feedback, regulatory changes, and recognized best practices. The following sections provideother corporate developments. Following is an overview of our corporate governance structure and processes, including key aspects of our board operations.

Maintaining a board of individuals independent of management, and of the highest personal character, integrity and ethical standards, is crucial.critical to the proper functioning of the board. The Nominating and Corporate Governance Committee also seeks to create a board that reflects a range of professional backgrounds and skills relevant to our business, as well aspromote diversity in the boardroom with respect to gender, age, ethnicity, skills, experience, perspectives, and ethnicity. Some of the most important skills and experiences our board seeks in potential director candidates are audit and financial proficiency, operator or general manager experience, and digital technology expertise. other factors. Our directordirectors’ biographies highlight the skills and experiencesfactors that led the board to conclude that the nominee should serve as a director.considered when nominating these individuals.

The Nominating and Corporate Governance Committee uses a variety of sources to identify potential candidates, including recommendations from independent directors or members of management, outside consultants, discussions with other persons who may know of suitable candidates and shareowner recommendations. Prospective candidate evaluations typically include the Nominating and Corporate Governance Committee’s review of the candidate’s background and qualifications, interviews with Committee members and other board members, and open discussions between the Committee and the full board. An outside consultant helps identify, screen and recruit director candidates in consultation with the Nominating and Corporate Governance Committee. This process allows for active and ongoing consideration of potential directors with a long-term focus on Company strategy.

|

1 | Board Composition Review | |

The board’s annual | ||

| 2 | Candidate Identification | |

The Nominating and Corporate Governance Committee uses a variety of sources to identify | ||

| 3 | Shortlisted Candidates | |

| The Nominating and Corporate Governance Committee maintains a diverse list of potential director candidates according to desired skills, experiences and | ||

| 4 | Recommendation, Nomination and Annual Election | |

| Candidates | ||

|

| Shareowner Recommendations, Nominations |

The Nominating and Corporate Governance Committee will consider shareownerProxy Access

Shareowner recommended director candidates are considered on the same basis as recommendations from other sources. Shareowners can recommend a director candidate to the Nominating and Corporate Governance Committee by submitting the name of the prospective candidate in writing to the following address: UPS Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Submissions should describemust contain the prospective candidate’s name and a detailed description of the experience, qualifications, attributes and skills that make the prospective candidateindividual a suitable director nominee.candidate.

| 10 |  | Notice of Annual Meeting of Shareowners and 2022 Proxy Statement |

In 2017, we proactively adopted aCorporate Governance

We also provide proxy access bylaw as part of our ongoing commitment to strong corporate governance practices following thoughtful discussions with shareowners

through the Company’s long-standing outreach program. We provide afor shareowner director nominees. A single shareowner, or group of up to 20 shareowners, that has owned at least 3 percent of UPS’s outstanding stock continuously for at least three years, may include up to 20 percent of the ability to includeboard seats or two directors (whichever is greater), as director nominees in UPS’s proxy materials for an annual meeting of shareowners. Shareowners may include in the proxy materials the greater of 20 percent of the board seats or two directors. Our Bylaws set forth the requirements for the formal shareowner nomination process for director candidates. These requirements are describedsummarized under “Other Information for Shareowners — Proxy Access, Shareowner Proposals and Nominations for Director at the 2020 Annual Meeting”Shareowners” on page 69.82.

Effective decision-makingA wide range of viewpoints is facilitated bycritical to effective board deliberations, corporate governance and oversight. Diversity with respect to gender, age, ethnicity, skills, experience, perspectives, and other factors is a variety of viewpoints. Diversity is an importantkey consideration forwhen identifying and recommending director nominees. The Nominating and Corporate Governance Committee assesses board diversity through periodic board composition evaluations. While the Company does not have a formal policy on board diversity, our Corporate Governance Guidelines emphasize diversity, and the Nominating and Corporate Governance Committee when identifying director nominees. The Committeeactively considers the board’s overall composition in light of race, gender, age and cultural background, as well as diversity in experiencerecruitment and skills relevant to the oversightnominations of a complex global business. The

Nominating and Corporate Governance Committee assesses the effectiveness of its diversity efforts through periodic evaluations of the board’s composition.

Our 12 director nominees include a diverse range of individuals, including three women, one African-American, two Europeans and a nominee who spent his entire career in Asia. The director nominees range between 48 and 73 years of age.candidates.

Gender |

| Age | ||||

|

|

| ||||

|  |  |

Board Refreshment and Succession Planning

|  | The Nominating and Corporate Governance Committee regularly considers the long-term Since The |

* Excludes current director Candace Kendle, whose board service will conclude at the 2019 Annual Meeting.

|

|

Having a significant majority of non-management independent directors encourages robust debate and challenged opinions in the boardroom.

| Our Corporate Governance Guidelines include director independence standards |

| 11 |

The board reviewedhas evaluated each director’s independence in February 2019 and considered whether there were any relevant relationships between UPS and each director, or any member of his or her immediate family. The board also examined whether there were any relationships between UPS and organizations where a director is or was a partner, principal shareowner or executive officer. This review allowed the board to determine whether any such relationships impacted a director’s independence. Specifically, the board evaluated certain ordinary course business transactions and relationships between UPS and the organizations that currently or in the prior year employed MichaelEva Boratto, Mike Burns, Franck Moison, John Stankey,Wayne Hewett, Angela Hwang, Kate Johnson, Russell Stokes and

Carol Tomé, Kevin Warsh, or their immediate family members.members, as an executive officer. The board also evaluated the ordinary course business transactions and relationships between UPS and any organizations where Rod Adkins, Wayne Hewett, Christiana Smith Shi and Kevin Warsh, or their immediate family members, were a partner or principal shareowner. In each case, no such transactions exceeded the thresholds in UPS’s Corporate Governance Guidelines. The board determined that none of these transactions or relationships were material to the Company, the individuals or the organizations with which they were associated.

As a result of this review, theThe board affirmativelyhas determined that all our directors (which includes alleach of the director nominees other(other than Chairman and Chief Executive Officer David Abney) areour current CEO, Carol Tomé), is independent. With respect to directors that served during 2021 but have retired, the board has determined that each such individual was independent. All members of the Audit Committee, Compensation and Human Capital Committee, Nominating and Corporate Governance Committee and Risk Committee are independent.

Based on the periodic evaluation and recommendation of the Nominating and Corporate Governance Committee, the board determines the most appropriate board leadership structure, for the Board of Directors at any given time. Historically, our Chief Executive Officer has served as Chairman of the Board, as all ten of our previous Chief Executive Officers also served as Chairman. This leadership structure has been effective for the Company.

The Nominating and Corporate Governance Committee makes recommendations to the board aboutincluding who should serve as ChairmanBoard Chair, and Chief Executive Officer,whether the roles of Board Chair and CEO should be separated or combined.

In connection with Carol Tomé’s election as CEO, the board then selects the Chairman and Chief Executive Officer. The board determined that UPS Chairman and Chief Executive Officer David Abney isit was in the best positionedinterests of the Company to continueenable Carol to lead the board at this time and to focus

the board’s attention on the issues of greatest importance toleading the Company, and its shareowners. Davidseparated the roles of Chair and CEO. Bill Johnson, who had been serving as our independent Lead Director, was appointed Board Chair on October 1, 2020.

Bill has primary responsibility for managingserved on our board since 2009 and had served as independent Lead Director since 2016. He has deep institutional knowledge of the Company’s dayCompany and provides strong continuity of leadership. He devotes significant time to day operations,understanding our business and hecommunicating with the CEO, and other directors, between meetings. He draws on his extensive knowledge of our business, industry, strategic priorities and competitive developments key customers and business partners to set the board’s agenda. David communicates UPS’s strategy to shareowners, employees, regulators, customers and the public. He provides open and frequent feedback to board members on significant matters within and outside of the board meeting cycle. David is available to all directors between meetings and meets regularlyagendas in collaboration with the lead independent director, as described below, to receive feedback from the board. HeCEO, and he seeks to ensure that board meetings are productive and interactions with the directors facilitate a useful exchange of viewpoints.

|

Independent oversight Carol is importantavailable to all directors between meetings and meets regularly with the Board Chair, and with the directors individually and as a group, to receive feedback from the board. Bill’s collaboration with Carol allows the board to focus attention on the issues of greatest importance to the board. Accordingly, in February 2016,Company and its shareowners and our CEO to focus primarily on leading the independent directors of the board appointed William “Bill” Johnson as lead independent director. Bill devotes significant time to understanding our business and communicating with the Chairman and other directors between meetings. He provides significant input into the board meeting agendas and he spends time with our Chairman and Chief Executive Officer after each board meeting to provide feedback. He also periodically meets with our largest shareowners to answer questions and to provide perspective on appropriate topics, such as the Company’s culture and governance practices.Company.

Our lead independent director’s leadership authority and responsibilities include:

|

Furthermore, all of the members of each of the Audit Committee, the Compensation and Human Capital Committee, the Nominating and Corporate Governance Committee and the Risk Committee are independent. Each committee is led by a chairperson who sets the meeting agendas and reports to the full board on the committee’s work.

Additionally, the independent directors meet in executive session without management present as frequently as they deem appropriate,at each board meeting, as described below. This structure provides the best form of leadership for the Company and its shareowners at this time.

Our independent directorsDirectors hold executive sessions without management present as frequently as they deem appropriate, typically at the time of each regular board meeting. The lead independent directorBoard Chair determines the agenda for each session,and presides at each session and, aftersession. The Board Chair generally invites the session, acts as a liaison

between the independent directors and the Chairman and Chief Executive Officer. The lead independent director may invite the Chairman and Chief Executive OfficerCEO to join a portion of the executive session for certain discussionsto receive feedback from the board and when deemed appropriate.appropriate otherwise. In addition, during the year the Board Chair meets individually with each director to discuss issues that are important to the board and to solicit and provide further feedback.

Board and Committee Evaluations

The board employs both an ongoing informal and a formal annual process to evaluate its performance and the contributions of individual directors to the successful execution of the board’s obligations. The Board Chair frequently considers the performance of the board and the board’s committees and has informal discussions about individual director contributions to the board. The Board Chair shares feedback from these discussions with the full board and with individual board members. In addition, during 2021 the CEO met individually with each director to discuss how best to utilize the director’s skills and experience. The feedback from these meetings was reviewed with the Board Chair.

|  | Notice of Annual Meeting of Shareowners and 2022 Proxy Statement |

Corporate Governance

Formal Evaluation Process

| 1 | Detailed Formal | |

| The | ||

| 2 | Questionnaires | |

All board and committee members complete a detailed confidential questionnaire each year. The questionnaire provides for quantitative ratings in key areas, including overall board effectiveness, meeting effectiveness, access to information, information format, board committee structure, access to management, succession planning, meeting dialogue, communication with the CEO, operational reporting, financial oversight, capital structure and financing, capital spending, long-term strategic planning, risk oversight, crisis management and time management. The questionnaire also allows directors to provide written feedback and make detailed anonymous comments. | ||

| 3 | Review | |

The results of the committee self-assessments are reviewed by each committee and discussed with the full board. The Chair of the Nominating and Corporate Governance Committee reviews the results of committee self-assessments and discusses the responses with the chairs of the other board | ||

| 4 | Follow-up | |

Matters requiring follow-up are addressed by the Chair of the Nominating and Corporate Governance Committee or the chairs of the other committees as appropriate. | ||

Result | Feedback from the evaluations has driven several |

The Chairman and the board’s lead independent director frequently discuss the performance of the board and the board’s committees, and have informal discussions about individual director contributions to the board. The lead independent director shares feedback from these discussions with the full board and with individual board members.

All board and committee members complete a detailed evaluation questionnaire each year. The board questionnaire provides for quantitative ratings in key areas, including overall board effectiveness, meeting effectiveness, access to information, information format, board committee structure, access to management, succession planning, meeting

dialogue, communication with the CEO, operational reporting, financial oversight, capital structure and financing, capital spending, long-term strategic planning, risk oversight, crisis management and time management. The questionnaire also allows directors to provide written feedback and make detailed anonymous comments.

Feedback from these evaluations in 2018 led to several important changes in board operations, including changes to board meeting agendas and recurring topics, additional attention to the succession planning process, and board committee membership rotations.

|

|

Majority Voting and Director Resignation Policy

Our Bylaws provide for majority voting in uncontested director elections. This means that in order to be elected, theThe number of votes cast for a nominee must exceed the number of votes cast against that person.

In accordance with our director voting policy, any Any incumbent director who does not receive a majority of the votes cast must offer to resign from the board. The

In such an event, the Nominating and Corporate Governance Committee will recommend to the board whether to accept or reject the director’s offer to resign after considering all relevant factors. The board will act on the recommendation within 90 days following certification of the election results.

Any director who offers to resign must recuse himself or herself from the board vote, unless the number of independent directors who were successful incumbents is fewer than three. The board will promptly disclose its decision regarding any director’s offer to resign, including its reasoning. If the board determines to accept a director’s offer to resign, the Nominating and Corporate Governance Committee will recommend whether and when to fill such vacancy or whether to reduce the size of the board.

| 13 |

Board Oversight of Risk |

| Board of Directors | |||

| |||

| Risk Committee | Audit Committee | Compensation and Human Capital Committee | Nominating and Corporate Governance Committee |

Oversees management’s identification and evaluation of strategic enterprise risks, including | Oversees policies with respect to financial risk assessment, including guidelines to govern the process by which major financial and accounting risk assessment and management is | Considers | Considers risks related to governance matters, including succession |

The board has established a Risk Committee comprised entirely of independent board members to assist in overseeing management’s identificationCompany’s Chief Legal and evaluation of enterprise risks. The Risk Committee met three times during 2018. In addition, the Company’s General Counsel, theCompliance Officer, Chief Information Officer, and the headVice President of the Company’s complianceCompliance and internal audit functions have regularly scheduled individual private meetingsInternal Audit each meet individually with the Risk Committee. Committee on a regular basis.

The Risk Committee also provides an annual update toupdates the full board annually on the Company’s enterprise risk management survey and risk assessment results. The update enables the board to provideprovides feedback to the Company about significant enterprise risks and to assessassesses the Company’s identification of its most significant risk areas. The Risk Committee also coordinates with the Audit Committee as necessary and appropriate to enable the Audit Committee to perform its risk related responsibilities.

The Audit Committee has certain statutory, regulatory, and other responsibilities with respect to oversight ofadditional risk assessment and risk management. Specifically, the Audit Committee is responsible for overseeing policiesoversight responsibilities, specifically with respect to financial risk assessment, including guidelines to governassessment. The Chief Legal and Compliance Officer, CEO, Chief Financial Officer and Vice President of Compliance and Internal Audit each meet individually with the process by which major financial and accounting risk assessment and management is undertaken by the Company.

|

on a regular basis.

Strategic Planning and Oversight

Oversight of strategy development and has significant oversight of our corporate strategy and long-range operating plans. Acting as a full board and through each independent board committee, the board is fully engaged in the Company’s strategic planning process.

Setting the strategic course of the Company involvesrequires a high level of constructive engagement between management and the board. The Company maintains a process that allows the board to leverage its substantial experience and expertise to remain fully engaged in the Company’s strategic planning process. Management develops and prioritizes strategic plans on an annual basis. Management then reviews these strategic plans with the board duringon an annual board strategy meeting,basis, along with the Company’s challenges, opportunities, industry dynamics, and legal, regulatory and governance developments, amongand other factors.

Management provides the board with comprehensive updates throughout the year regarding progress on the implementation and resultsCompany’s strategic plans. Management also provides regular updates regarding the achievement of the Company’s strategic plans, as well as monthly updates

| 14 |  | Notice of Annual Meeting of Shareowners and 2022 Proxy Statement |

This process allows the board to understand and impact the Company’s strategic plans, including plans related to returnTable of capital to shareowners, mergers and acquisitions, competitive challenges, changing marketplace conditions and operational technologies. As a result, the board has substantial oversight of the development and implementation of the Company’s strategic plans and the board is able to effectively monitor the Company’s progress with respect to the strategic goals and objectives.Contents

Succession planning and talent development are important at all levels within our organization. The board oversees management’s emergency and long-term succession plan for key positionsplans at the seniorexecutive officer level, and most importantly for the Chief Executive OfficerCEO position. The board annually reviews succession plans for senior management including the CEO, all in the context of the Company’s overall business strategy and with a focus on risk management. More broadly, the board and the CEO,Compensation and Human Capital Committee are regularly updated on key talent indicators for the overall workforce, including both a long-term succession plandiversity, recruiting and an emergency succession plan. development programs.

The board’s succession planning activities are ongoing and strategic and may beare supported by board committees and independent third-party consultants.consultants as needed. In addition, the CEO annually provides hisan assessment to the board of senior leaders and their potential to succeed at key senior management positions. Recently, the board supported the hiringAs a part of external

The board also regularly evaluates succession plans in the context of the Company’s overall business strategy and with a focus on risk management. Potentialthis process, potential leaders interact with board members through formal presentations and during informal events. More broadly,

We also utilize a formal director engagement program in which directors meet with individual executive officers, visit Company operations, participate in employee events and receive in-depth subject matter updates outside of the regular board is regularly updated on key talent indicators formeeting process. These additional engagements encourage the overall workforce, including diversity, recruitingongoing exchange of ideas and development programs.information between directors and management, facilitate the board’s oversight responsibilities, and support succession planning efforts.

The board held 5five meetings during 2018.2021. Also, during 2018,2021, the Audit Committee met 10ten times, the Compensation and Human Capital Committee met 5five times, the Nominating and Corporate Governance Committee met 4four times and the Risk Committee met 3three times. A typical UPS board meeting occurs over the course of two days.The Executive Committee met one time in 2021. Prior to board meetings, the board meeting, the lead independent directorBoard Chair and the board’s committee chairs work with management to determine and prepare agendas for the meetings. The boardBoard meetings generally occur over two days. Board committees generally meet on the first day of the board meeting, followed

|

|

2021.

We are committed to conducting our business in accordance with the highest ethical principles. Our Code of Business Conduct is applicable to anyone who represents UPS, including our directors, executive officers and all other employees and agents of UPS. A copy of our Code of Business Conduct is available on the governance section of our investor relations website at www.investors.ups.com.

| 15 |

Conflicts of Interest and Related Person Transactions

Our Audit Committee is responsible for overseeing our Code of Business Conduct, which includes policies regarding conflicts of interest. The Code requires employees and directors to avoid conflicts of interest, defined as situations where the person’s private interests conflict, or may appear to conflict, with the interests of UPS.

The board has adoptedWe maintain a written related person transactions policy that applies to any transaction or series of transactions in which: (1) the Company or any of its subsidiaries is a participant; (2) any “related person” (executive officer, director, greater than 5% beneficial owner of the Company’s common stock, or an immediate family member of any of the foregoing) has or will have a material direct or indirect interest; and (3) the aggregate amount involved since the beginning of the Company’s last completed fiscal year will exceed or may reasonably be expected to exceed $100,000.

The policy provides that related person transactions that may arise during the year are subject to the Audit Committee approval or ratification.Committee’s reasonable prior approval. In determining whether to approve or ratify a transaction, the Audit Committee will consider, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstance, the extent of the related person’s interest in the transaction, whether the transaction would impair

At least annually, each director and executive officer completes a detailed questionnaire that disclosesin which they are required to disclose any business relationships that may give rise to a conflict of interest, including transactions where UPS is involved and where an executive officer, a director or a related person has a direct or indirect material interest. We also review the Company’s financial systems and any related person transactions to identify potential conflicts of interest. The Nominating and Corporate Governance Committee reviews thea summary of this information from the questionnaire and our financial systems and makes recommendations to the Board of Directors regarding the independence of each board member.member’s independence. We have immaterial normalordinary course of business transactions and relationships with companies with which our directors are associated. The Nominating and Corporate Governance Committee reviewed the transactions and relationships that occurred since January 1, 20182021 and believes they were entered into on terms that are both reasonable and competitive and did not affect director independence. Additional transactions and relationships of this nature may be expected to take place in the ordinary course of business in the future.

We prohibit our executive officers and directors from hedging or pledging their ownership in UPS stock. Specifically, they are prohibited from purchasing or selling derivative securities relating to UPS stock and from purchasing financial instruments that are designed to hedge or offset any decrease in the market value of UPS securities. Since 2014 we have prohibited our executive officers and directors from entering into pledges of UPS stock.

| 16 |   | Notice of Annual Meeting of Shareowners and |

Corporate Governance

|

During this proxy season,Maintaining open and honest dialogs with our stakeholders is an important component of our corporate culture. Our management team participates in numerous investor meetings throughout the year to discuss our business, strategy and financial results. This includes in-person, telephone and webcast conferences, as well as key site visits. Our Investor Relations team shares feedback and provides regular updates to the board on investor sentiment.

In addition, each year we undertake an Environmental, Social and Governance (“ESG”) stakeholder outreach program in which we discuss progress on our ESG journey. This year we contacted holders of over 43%47% of our class B common stock to discuss our corporate governance practices and executive compensation programs. as a part of this program.

We also proactively correspond with other key investorsstakeholders throughout the year. We share feedback from these engagements with the board, the Compensation and Human Capital Committee, and the Nominating and Corporate Governance Committee as appropriate.

|   | |||

We | The Compensation | |||

● Announced a carbon neutral by 2050 goal, including several shorter and medium term goals; ● Expanded our sustainability disclosure, including publishing GRI, TCFD and SASB reports; ● Increased our commitments to diversity, equity and inclusion, volunteerism and charitable giving; ● Separated the Board Chair and CEO roles; ● Appointed an independent Board Chair; ● Increased board diversity; ● Adopted policies providing for an annual say on pay vote; ● Adopted proxy access; and ● | ● Updated the peer group used by the Committee for executive and director compensation market comparisons; ● Enhanced the performance-based equity component in our compensation ● Eliminated single-trigger equity vesting following a change in control; ● Added relative total shareowner return as a ● Adopted performance metrics under incentive compensation plans better designed to tie payouts to increases in shareholder value; ● Provided additional detail around the performance measures used for our annual and long-term incentive plans; ● Eliminated tax gross-ups; ● Entered into protective covenant agreements in favor of UPS with certain executive officers; and ● Added an individual payout cap to our annual incentive | |||

Our management team participates in numerous investor meetings throughout the year to discuss our business, our strategy and our financial results. These meetings include in-person, telephone and webcast conferences, as well as headquarters and facility visits within the United States and in key international locations. In addition, our lead independent director meets with our largest shareowners to answer questions and to provide perspective on the Company’s culture and governance practices.

Materials from our investor presentations, including information on the work of our board and its committees, are available on our investor relations website at www.investors.ups.com.

|

|

Communicating with ourthe Board of Directors

Stakeholders may communicate directly with ourthe board, with ourthe non-management directors as a group, or with the lead independentany specific director, may do so by writing to the UPS Corporate Secretary, 55 Glenlake Parkway, N.E., Atlanta, Georgia 30328. Please specify to whom your letter should be directed. After review by the Corporate Secretary,

| 17 |

Political Contributions and Lobbying

Our responsibleOverview

Responsible participation in the U.S. political process is important to theour success of our business and the protection of shareowner value. We participate in this process in accordance with good corporate governance practices. Our Political Contributions and Lobbying Policy (“policy”) is summarized below and is available at www.investors.ups.com. The following discussion highlights our practices

| ● | The Nominating and Corporate Governance Committee oversees the policy; | |

| ● | Corporate political contributions are restricted; | |

| ● | We publish a semi-annual political contribution report on our investor relations website; and | |

| ● | Eligible employees can make political contributions through a Company-sponsored political action committee (UPSPAC). UPSPAC is organized and operated on a voluntary, nonpartisan basis and is registered with the Federal Election Commission. |

Oversight and procedures regarding politicalProcesses

| ● | Political contributions are made in a legal, ethical and transparent manner that best represents the interests of stakeholders. | |

| ● | Political and lobbying activities require prior approval of the UPS Public Affairs department and are subject to review (and in some cases prior approval) by the Nominating and Corporate Governance Committee. | |

| ● | Senior management works with Public Affairs on furthering our business objectives and protecting and enhancing shareowner value. | |

| ● | The Chief Corporate Affairs Officer reviews political and lobbying activities and regularly reports to the board and the Nominating and Corporate Governance Committee. |

Lobbying and lobbying:Trade Associations

| ● | Public Affairs coordinates our lobbying activities, including engagements with federal, state, and | |

| ● | Lobbying activities require prior approval of Public Affairs. | |

| ● | The Nominating and Corporate Governance Committee regularly reviews UPS’s participation in trade associations and other tax-exempt organizations that engage in lobbying to determine if our involvement is consistent with UPS business objectives and whether participation exposes the Company to excessive risk. | |

| ● | Lobbying activities are governed by comprehensive policies and practices designed to facilitate compliance with laws and regulations, including those relating to the lobbying of government officials, the duty to track and report lobbying activities, and the obligation to treat lobbying costs and expenses as nondeductible for tax purposes. |

Political contributions are made in a legal, ethical and transparent manner that we believe best represents the interests of our shareowners. All political and lobbying activities are conducted only with the prior approval of our Public Affairs department and in accordance with the terms of our policy. Senior management works with Public Affairs to focus our involvement at all levels ofActivity Transparency

government on furthering our business objectives and our goals of protecting and enhancing shareowner value. The president of our Public Affairs department reviews all UPS political and lobbying activities and regularly reports to the board and to the Nominating and Corporate Governance Committee.

| ● | We are transparent in our political activities. | |

| ● | We publish a semi-annual report, which is reviewed and approved by the Nominating and Corporate Governance Committee. | |

| ● | The report provides: | |

| ● | Amounts and recipients of any federal and state political contributions in the United States (if any such expenditures are made); and | |

| ● | Payments to trade associations that receive $50,000 or more and that use a portion of the payment for political contributions, as reported by the trade association to us. | |

| ● | The report is available on our investor relations website at www.investors.ups.com | |

| ● | We also publicly file a federal Lobbying Disclosure Act Report each quarter, providing information on activities associated with influencing legislation through communications with any member or employee of a legislative body, or with any covered executive branch official. This report discloses expenditures for the quarter, describes the specific pieces of legislation that were the topic of communications, and |

Our Public Affairs department is responsible for coordinating our lobbying activities, including engagements with federal, state, and local governments. UPS is a member of a variety of trade associations and other tax exempt organizations that engage in lobbying. The Company may participate in lobbying activities when involvement is consistent with specific UPS business objectives. These decisions are subject to board oversight and are regularly reviewed by the Nominating and Corporate Governance Committee.

We have comprehensive policies, practices and tracking mechanisms to support and govern our lobbying activities. These mechanisms cover compliance with laws and regulations regarding the lobbying of government officials, the duty to track and report lobbying activities, and the obligation to treat lobbying costs and expenses as nondeductible for tax purposes. All lobbying contacts with covered government officials must be coordinated with and approved by the president of our Public Affairs department.

| 18 |   | Notice of Annual Meeting of Shareowners and |

Corporate Governance

We are committed to meaningful transparency with respect tothe world’s premier package delivery company and a leading provider of global supply chain management solutions. We offer a broad range of industry-leading products and services through our political activities. We publish a semi-annual report disclosingextensive presence in North America; Europe; the following information at our investor relations website at www.investors.ups.com, all of which is reviewedIndian sub-continent, Middle East and approved by the Company’s NominatingAfrica (“ISMEA”); Asia Pacific and Corporate Governance Committee prior to publication:

UPS also files a publicly available federal Lobbying Disclosure Act Report each quarter, providing information on activities associated with influencing legislation through communications with any member or employee of a legislative body or with any covered executive branch official. The report also provides disclosure on expenditures for the quarter, describes the specific pieces of legislation that were the topic of communications, and identifies the individuals who lobbied on behalf of UPS.insurance.

UPS files similar periodic reports with state agencies reflecting state lobbying activities which are also publicly available.

We areoperate one of the world’s largest private employers.airlines and one of the largest fleets of alternative fuel vehicles under a global UPS brand that stands for quality and reliability. We serve millions ofdeliver packages each business day for approximately 1.7 million shipping customers around the world, we operateto 11.8 million delivery customers in more thanover 220 countries and territories, and many investors include our shares in their portfolios.territories. In 2021, we delivered an average of 25.2 million packages per day, totaling 6.4 billion packages during the year. Our success depends on economic stability, global trade and a society that welcomes opportunity. We understand the importance of acting responsibly as a business, an employer and a corporate citizen.

Engagement onEconomic, environmental and social sustainability issues is importantrisks and opportunities are considered as part of our comprehensive enterprise risk management program. The board regularly reviews the effectiveness of our risk management and due diligence processes related to our stakeholders. Ourmaterial sustainability topics. In addition, the board actively considers these factors in connection with the board’s involvement in UPS’s strategic planning process. The board delegates authority for day-to-day management of economic, environmental, and socialsustainability topics to UPS management. TheOur Chief Corporate Affairs Officer reports directly to the Company’s CEO and regularly reports to the board oversees economic, environmentalregarding sustainability strategies, priorities, goals and social issues and is in touch with stakeholder concerns through a number of processes. For example,performance. In addition, the board is regularly briefed on issues of concern for customers, unions, employees, retirees, investors and investors.other stakeholders. Furthermore, the board oversees all efforts by UPS management to developmanagement’s development of our values, strategies and policies related to economic, environmental and social impacts.

UPS was among the first Fortune 100 companies to appoint a chief sustainability officer. Our chief sustainability officer regularly reports to the board regarding sustainability strategies, priorities, goals, and performance. In addition, members of the board review the contents of our sustainability report each year and provide feedback to the Company.

Economic, environmental and social risks are part of our comprehensive enterprise risk management program. The board reviews the effectiveness of our risk management and due diligence processes related to economic, environmental, and social topics. In addition, the board actively considers economic, environmental and social issues in connection with the board’s involvement in UPS’s strategic planning process.

Each year we publish a corporate sustainability report showcasing the aspirations, achievements, and challenges of our commitment to balancing the social, economic and environmental aspects of our business. The report is availablereviewed by the board prior to publication. Following is a list of key goals:

| By 2022: | ||

| ● | 28% women in full-time management globally |

| ● | 35% ethnically diverse full-time management in the U.S. | |

| By 2025: | ||

| ● | 40% alternative fuel in ground operations |

| ● | 25% renewable electricity in facilities |

| By 2030: | ||

| ● | 30 million volunteer hours (2011 baseline) |

| ● | 50 million trees planted (2012 baseline) |

| By 2035: | ||

| ● | 30% sustainable aviation fuel |

| ● | 50% reduction in CO2 per global small package (2020 baseline) |

| ● | 100% renewable electricity in facilities |

| By 2050: | ||

| ● | Achieve carbon neutrality |

For more information, please visit www.about.ups.com. Our ESG goals are aspirational and may change. Statements regarding our goals are not guarantees or promises that they will be met.

| 19 |

Our success is dependent upon our people, working together with a common purpose. We have approximately 534,000 employees (excluding temporary seasonal employees), of which 444,000 are in the U.S. and 90,000 are located internationally. Our global workforce includes approximately 89,000 management employees (44% of whom are part-time) and 445,000 hourly employees (51% of whom are part-time). More than 70% of our U.S. employees are represented by unions, primarily those employees handling or transporting packages. In addition, approximately 3,100 of our pilots are represented by the Independent Pilots Association.

We believe that UPS employees are among the most motivated, highest-performing people in the industry and provide us with a meaningful competitive advantage. To assist with employee recruitment and retention, we continue to review the competitiveness of our employee value proposition, including benefits and pay, the range of continuous training, talent development and promotional opportunities.

Oversight and management

We are creating an inclusive and equitable environment that brings together a broad spectrum of backgrounds, cultures and stakeholders. Leveraging diverse perspectives and creating inclusive environments improves our organizational effectiveness, cultivates innovation, and drives growth.

Our Board of Directors and its committees provide oversight on human capital matters through a variety of methods and processes. These include regular updates and discussion around human capital transformation efforts, technology initiatives impacting the workforce, health and safety matters, employee survey results related to culture and other matters, hiring and retention, employee demographics, labor relations and contract negotiations, compensation and benefits, succession planning and employee training initiatives.

In addition, the Compensation and Human Capital Committee charter was expanded last year to include oversight of performance and talent management, diversity, equity and inclusion, work culture and employee development and retention. We believe the board’s oversight of these matters helps identify and mitigate exposure to labor and human capital management risks, and is part of the broader framework that guides how we attract, retain and develop a workforce that aligns with our values and strategies.

Total rewards

We offer competitive compensation and benefits. In addition, our long history of employee stock ownership aligns the interests of our management team with shareowners. In the U.S., benefits provided to our non-union employees typically include:

| ● | comprehensive health insurance coverage; | |

| ● | life insurance; | |

| ● | short- and long-term disability coverage; | |

| ● | child/elder care spending accounts; | |

| ● | work-life balance programs; | |

| ● | an employee assistance program; and | |

| ● | a discounted employee stock purchase plan. |

We invest in our people by offering a range of other benefits, such as paid time off, retirement plans, and education assistance. In the U.S., these other benefits are generally provided to non-union employees without regard to full-time or part-time status.

Transformation and human capital

As we expand and enter new markets, and seek to capture new opportunities and pursue growth, we need employees to grow and innovate along with us. We believe that transforming the UPS employee experience is foundational to our success. This requires a thoughtful balance between the culture we have cultivated over the years and the new perspectives we need to take the business into the future. This investment in capabilities to transform our business includes investing in employee growth opportunities such as professionalism, technical and other training.

| 20 |  | Notice of Annual Meeting of Shareowners and 2022 Proxy Statement |

Corporate Governance

Employee health and safety

We are committed to industry-leading employee health, safety, and wellness programs across our workforce. We develop a culture of health and safety by:

| ● | investing in safety training and audits; | |

| ● | promoting wellness practices which mitigate risk; and | |

| ● | offering benefits that keep employees safe in the workplace and beyond. |

Our local health and safety committees coach employees on UPS’s safety processes and are able to share best practices across work groups. Our safety methods and procedures are increasingly focused on the variables associated with residential delivery environments, which have become more common with the growth in e-commerce. We monitor our performance in this area through various measurable targets including lost time injury frequency and the number of recorded auto accidents.

Collective bargaining

We bargain in good faith with the unions that represent our employees. We frequently engage union leaders at www.sustainability.ups.com.the national level and at local chapters throughout the United States. We participate in works councils and associations outside the U.S., which allows us to respond to emerging regional issues abroad. This work helps our operations to build and maintain productive relationships with our employees.

Our Corporate Governance Guidelines and the charters for each of the board’s committees are available on the governance section of our investor relations website at www.investors.ups.com. The charters for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Risk Committee also are available on the governance section of our investor relations website. Each committee reviews its charter annually to determine if any

changes are needed.annually. In addition, the Nominating and Corporate Governance Committee reviews theour Corporate Governance Guidelines on an annual basisannually and recommends any changes to the board for approval. When making changes to theamending our committee charters or Corporate Governance Guidelines, we consider current governance trends and best practices, changes in regulatory requirements, advice from outside sources and input from our investors.stakeholders.

| |

|

|

Proposal 1 — Director Elections

What am I voting on?

Vote Required:A director will be elected if the number of votes cast |

The board has nominated the 12 persons named below for election as directors at the Annual Meeting. TheIf elected, all nominees will serve until the next Annual Meeting and until their respective successors are elected and qualified. Each nominee wasAll nominees were elected by shareowners at our last Annual Meeting. If any nominee is unable to serve as a director, which we do not anticipate, the board may reduce the number of directors that serve on the board or choose a substitute nominee. Any nominee who is currently a director, and for whom more votes are cast against than are cast for, must offer to resign from the board. Current director

Candace Kendle’s board service will conclude at the 2019 Annual Meeting. We thank her for her many years of dedicated service to the Company and the Board of Directors.

Biographical information about the director nominees for director appears below, including information about the experience, qualifications, attributes, and skills considered by our Nominating and Corporate Governance Committee and board in determining that the nominee should serve as a director. For additional information about how we identify and evaluate nominees for director, see “Corporate Governance — Selecting Director Nominees” on page 10.

|

UPS | Career Carol was appointed UPS’s Chief Executive Officer effective June, 2020. As CEO, Carol has primary responsibility for managing the Company’s day-to-day operations, and for developing and communicating our strategy. She was Chief Financial Officer of The Home Depot, Inc., one of the world’s largest retailers, from 2001; and Executive Vice President Corporate Services from 2007 until her retirement in 2019. At The Home Depot, she provided leadership in the areas of real estate, financial services and strategic business development. Her corporate finance duties included financial reporting and operations, financial planning and analysis, internal audit, investor relations, treasury and tax. She previously served as Senior Vice President Finance and Accounting and Treasurer from 2000 until 2001; and from 1995 until 2000 she served as Vice President and Treasurer. Carol serves on the Board of Directors for Verizon Communications, Inc. and served on the Board of Directors of Cisco Systems, Inc. until 2020. She also served as a Trustee of certain Fidelity funds in 2017. Reasons for election to the UPS Board Carol has a thorough understanding of our strategies and operations as a result of serving as Chief Executive Officer, and from her extensive experience gained from serving on the board and as Chair of the Audit Committee prior to becoming Chief Executive Officer. She has an in-depth knowledge of logistics and has broad experience in corporate finance and risk and compliance gained throughout her career at The Home Depot. She brings the experience of having served as Chief Financial Officer of a complex, multi-national business with a large, labor intensive workforce. Carol also has experience with strategic business development, including e-commerce strategy. | |

Age: Director since 2003 Skills and Experience - CEO experience - CFO experience - Consumer retail - Digital technology - Risk and compliance Other Public Company Boards - Board Committee - Executive (Chair) | |||

David became UPS’s Chief Executive Officer in 2014, and assumed the role of Chairman of the Board of Directors in 2016. David previously served as chief operating officer since 2007, overseeing logistics, sustainability, engineering and all facets of the UPS transportation network. Before serving as COO, David was president of UPS International, leading the company’s strategic initiative to increase its global logistics capabilities. During his career, he was also involved in a number of global acquisitions that included the Fritz Companies, Stolica, Lynxs, and Sino-Trans in China. Earlier in his career, he served as president of SonicAir, a same-day delivery service that signaled UPS’s move into the service parts logistics sector. David began his UPS career in 1974 in Greenwood, Mississippi.

In addition to his corporate responsibilities, David serves as a Trustee of The UPS Foundation and as a Trustee of the Annie E. Casey Foundation. He is the 2019 Chair Elect, Executive Governing Committee Member of the Metro Atlanta Chamber of Commerce, is the former Chairman and current member of the World Affairs Council of Atlanta, and is a member of the Business Roundtable. David currently serves as a board member of the nonprofit organization, Catalyst. He joined the Board of Directors of Macy’s, Inc. in 2018. He served on the Board of Directors of Johnson Controls International plc, until 2018.

Reasons for election to the UPS Board

| ||

| 22 |  | Notice of Annual Meeting of Shareowners and |

Our Board of Directors

| Rodney Former Senior Vice | Career Rod is President of 3RAM Group LLC, a private company specializing in capital investments, business consulting and property management services. Prior to that role, Rod served as IBM’s Senior Vice President of Corporate Strategy before retiring in 2014. Rod was previously Senior Vice President, Systems and Technology Group, a position he held since 2009, and senior vice president of STG development and manufacturing, a position he held since 2007. In his over 30-year career with IBM, a multinational technology company, Rod held a number of other development and management roles, including general management positions for the PC Company, UNIX Systems and Pervasive Computing. Rod currently serves as non-executive Chairman of Avnet, Inc., in addition to serving on the Boards of Directors for PayPal Holdings, Inc. and W.W. Grainger, Inc. He also served on the Board of Directors for PPL Corporation until 2019. Reasons for election to the UPS Board As a senior executive of a public technology company, Rod gained a broad range of experience, including experience in emerging technologies and services, global business operations, and supply chain management. He is a recognized leader in technology and technology strategy. In addition, Rod has experience serving as a director of other publicly traded companies. | |

Age: Director since 2013Skills and Experience - Digital technology- Risk and compliance - Supply chain management - Technology and technology strategy Other Public Company Boards - Avnet, Inc.- PayPal Holdings, Inc.- Board Committees - Risk (Chair)- Compensation | |||